What Is Stock Exchange. Work or services which may either be personal manual efforts or intellectual to a common.

ExecutiveLP provides sole proprietors with essential consulting services to help them manage their legal liabilities maintain adequate insurance.

. Sole proprietorships and corporations B. The characteristics of partnerships are different from the sole proprietorships already studied in basic accounting. FINANCIAL ACCOUNTING - I Unit-1.

You are not held personally responsible for your LLCs business decisions. Stock in exchange for the sole proprietorship assets is transitory and without substance for tax purposes because it is apparent that the assets of the sole proprietorship are transferred to X to enable Y to acquire those assets without the recognition of gain to A. The sole proprietorship is the simplest business form to adopt and maintain as there are almost no required filings or registrations other than tax filings.

The sole proprietor has to be a jack of all trades in every sole proprietorship. There is no mandatory filing requirement on the state level. The startup costs for a sole proprietorship.

Lowering the prices of all consumer products. All of the answer choices are correct. Financial Statements of Sole Proprietorship from Complete and Incomplete Records 55 20 Unit-4.

Average Variable Costs Formula. Business Studies Class 12 Case Studies With Solutions. However a sole proprietor may register a trade name.

A shared control unlimited liability tax advantages increased skill and resources. The assets and liabilities of the business are one and the same as the owner. Income Elasticity Of Demand Formula.

The increased role of ICT in all walks of life cannot be overemphasized and is becoming an. These multiple roles could result from necessity inability to pay for qualified staff or choice. Increasing profits for businesses.

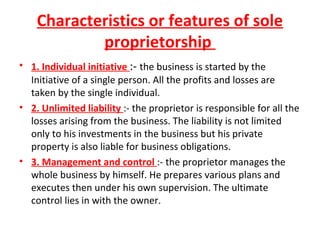

Therefore a Company form of business organisation came into existence to do away with the defects of sole proprietorship. So thats the reason the legal formalities is also an important characteristic of sole proprietorship. If a sole proprietorship is doing business under a name other than the owners true name a fictitious name filing must be made with the Secretary of State and renewed every five years.

Theoretical Frame Work UnitsTopics Learning Outcomes Introduction to Accounting Accounting- concept objectives advantages and limitations types of accounting. Difference Between Sole Proprietorship And Partnership. The term sole proprietorship means that the business is the same as its owner.

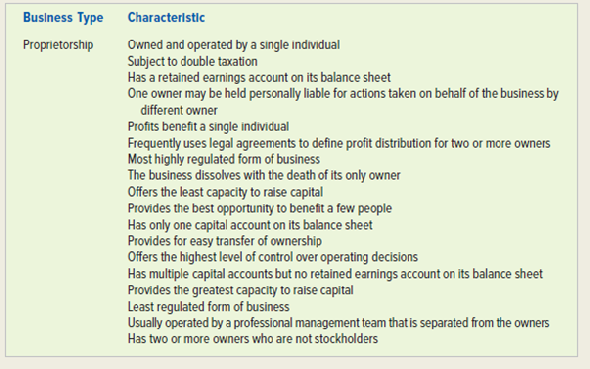

Easy transfer of ownership is a characteristic of which form of business organization. The sole trader business is the easiest business structure because there is a very low capital invested in it and has minimum formalities also. 11 Match the following forms of business organization with the set of attributes that best describes that form of business.

Computers in Accounting 15 08 Part C. A sole proprietor is a one-person business without a legal entity like a corporation LLC or partnership. He is the executive for the business the account officer the marketer etc.

Accounting leading to the preparation of accounts for a sole proprietorship firm. There cannot be a partnership without contribution of money property or industry ie. Sole proprietorship and partnership forms of business organisations could not meet the growing demands of a very big business because of their limitations such as limited capital limited managerial ability unlimited liability and other drawbacks.

In which forms of business organization are the owners personally liable for all the debts of the business. You are the only business owner and are fully responsible for all financials including any potential debt. Most people who are convicted of a felony spend time in prison or jail as part of their punishment under law.

Raising the quality of all consumer products. Accordingly the ruling treats A as transferring its sole proprietorship assets directly to Y in a transfer to which 351. Product differentiation is the process of identifying and communicating the unique qualities of a brand compared to its competitors.

Supply Curve Of A Firm. For which of the following markets. Some of the more important characteristics are as follows.

Self-employment means that you are the sole proprietor of the business a member of a business partnership or an independent contractor. A limited liability company is a combination of the limited liability characteristic of a corporation and the pass-through taxation benefits of a sole proprietorship or partnership. Under law a felony is the most severe class of crime.

Leave a Comment Cancel reply. Unwillingness of distribution channels to deal in products of small manufacturing units. The students are also familiarized with basic calculations of Goods and Services Tax GST in recording the business transactions.

Competition from the big business counterparts on grounds of higher cost and inferior quality characteristic of small business. Making a variety of products available to them. And you are only taxed once at the.

Project Work 20 20 PART A. The Sole Proprietorship is the nimblest least expensive type of business yet it is also the most exposed because the sole proprietor has unlimited financial and legal liability for debts and legal obligations of the business. A statutory trust is a business trust type of entity.

What Is Business Services. Sole proprietorship partnership or corporation. As per a census of small scale units in India mostly small business enterprises are run as sole- proprietorship and partnership.

Channels of distribution benefit consumers by A. However serving time incarcerated is not a mandatory characteristic of being a convicted felon. A convicted felon is by definition someone who has been convicted of a felony.

Either way the business would suffer somehow because as good as the sole proprietor is at multiple roles he isnt an expert in. The accounting treatment of GST is confined to the syllabus of class XI. If you establish an LLC you are separate from your business like a corporation.

Sole Proprietorship Meaning Features Merits Demerits Sole Trading Concern Meaning Characteristics Ad Sole Proprietorship Merit Business Organization

Sole Proprietorship Management Guru Sole Proprietorship Human Resource Development Performance Appraisal

Solved Characteristics Of Sole Proprietorships Partnerships And Chegg Com

Corporate Structure Hierarchy Sole Proprietorship Leadership Management Business Systems

Difference Between Sole Proprietorship Partnership Hsc Class 11 Class 12 Syjc Forms Of Business Organisa Business Studies Sole Proprietorship Study

Sole Proprietorship Its Characteristic Sole Proprietorship Sole Characteristics

Learn About Characteristics Of Proprietorship Chegg Com

Sole Proprietorship Definition Features Characteristics Advantage Disadvantages

What Are The 5 Characteristics Of Sole Proprietorship Sole Proprietorship Legal Separation What Is 5